Are you tracking how money enters and leaves your life?

This is the first post in my Money Vital Signs series- 5 short posts to understand your financial status quo.

How much did you earn last year?

How much did you spend?

How much did you save?

Don’t know … you’re not alone. Financial planners and wealth experts will say you need to create a budget.

In this post we will:

- Discuss income, expenses, needs and wants

- Create your Cash Flow statement

Since the Royal Commission of 2018/19, whenever we ask a bank for money, we’re forced to reveal all of our deep, dark spending habits.

I hate the word “budget”.

For me, it conjures up images of treasurers telling me I’ll be paying more tax next year to cover a growing government deficit.

It’s also a restrictive word- like a noose strangling our ability to enjoy life.

I hate the word “diet” for the same reason.

So let’s get rid of the “B” word and call it our Cash Flow.

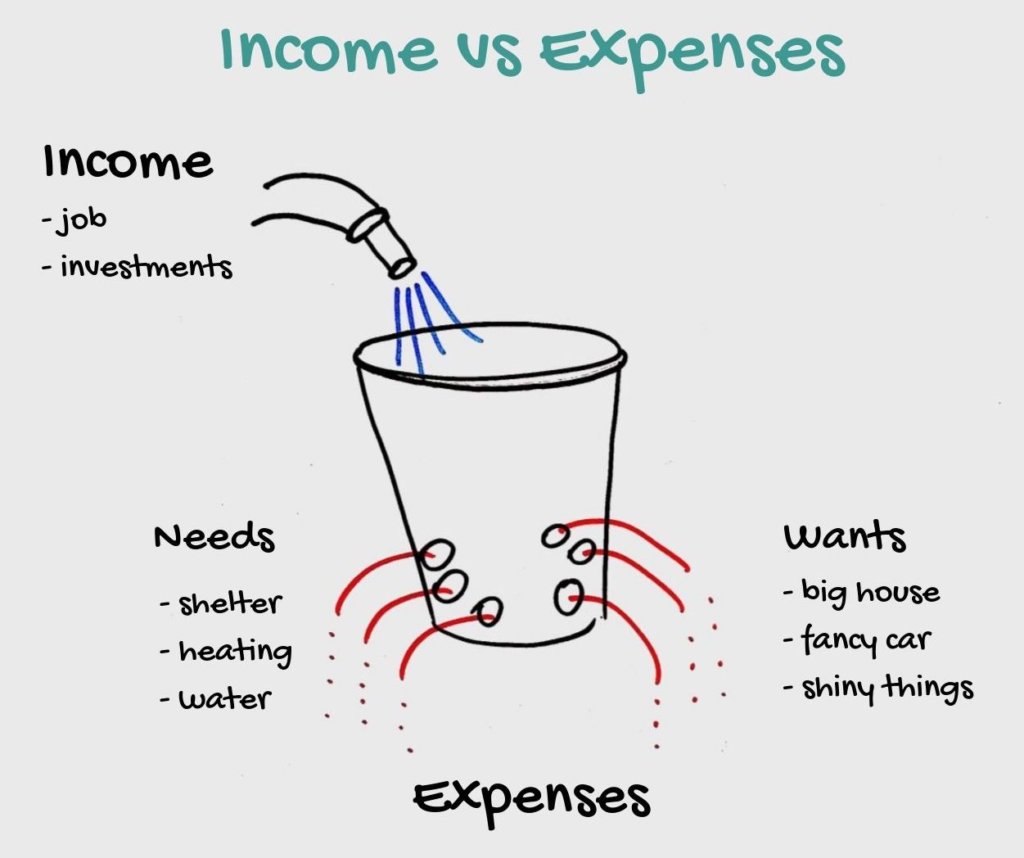

Buckets, Hoses and Holes- How Does Your Cash Flow?

Imagine that your bank account is a bucket.

At the top is a watering hose filling the bucket with water. The hose is an Income pipeline; the water is the money. As water flows in, the bucket fills up.

At the bottom of the bucket are two types of holes that represent your spending or Expenses– your Needs and Wants.

Needs are essential or non-discretionary spending. These include things like food, power and petrol. A doctor’s salary should cover these without too much pain.

Wants are non-essential or discretionary spending. These include overseas holidays, expensive handbags, shiny watches and fast cars. We can include the bigger-than-necessary home in this category too.

Some holes drain small amounts of money every month like a Netflix subscription while others haemorrhage regular significant amounts like mortgage repayments and private school fees.

Cash Flow is about Income and Expenses and their relationship with each other.

What Are The 3 Keys to Financial Success?

There are just three principles for financial success:

1. Spend less than you make

2. Invest the surplus

3. Use debt wisely

Understanding how your cash comes in and where it goes is critical.

In short, there needs to be more money coming into your bucket than there is escaping out the bottom.

How Does Your Cash Flow?

Now it’s time to look at reality.

When was the last time you took a good look at how your cash flows? Usually, the only times we do it is when we’re asking a bank for money, getting a new credit card or face one of those “oh sh!t moments”- a.k.a. BAS quarterly payment time.

Creating your cash flow statement is simple and should only take 15-30 minutes-

Record Your Vitals #1 – Create Your Cash Flow Statement

I’ve created a Cash Flow Spreadsheet just for you with sections allocated to all major areas of spending faced by doctors.

Click to download the Medical Vital Signs spreadsheet and go to the Cash Flow tab.

Step 1- Fill in your monthly Income into the green boxes. To accommodate for the income that fluctuates and does not come in monthly, take the annual amount and divide it by 12. It doesn’t need to be perfect, but the closer you can get to reality, the better.

Step 2- Fill in your monthly Expenses into the yellow boxes. The spreadsheet will calculate your annual cash flow.

Step 3- Review your last tax statement and three months of credit card statements (12 if you have the time). You might find you’ve been paying for things you never knew about- like cash advance fees, subscriptions you don’t use and your partner’s online shopping addiction.

Step 4- Ask yourself these questions:

- Am I cash flow positive or negative

? Is this safe? Or do I need to take drastic action?- How has this been trending in the past 1 year, 3 years, 5 years?

- Am I headed in the right direction?

Using The Information

Analysing my Cash Flow made me realise that my biggest expenses in descending order are:

- Tax

- Mortgage repayments

- Insurance

- Holidays

- Childcare

I also realised that I was being charged cash advance fees on my Sportbet account by my credit card. See you later, random bets on the Footy.

By taking stock of where our money goes, we can:

- Project future cash flows

- Identify opportunities to adjust behaviours e.g. increase income, reallocate spending

- Plan for upcoming spending events e.g. house purchase, school fees, new car

- Determine if and how we can reach our future goals

- Reward ourselves if we are doing well

Now you know how YOUR Cash Flows, click here for Money Vital Sign #2- Your Net Worth.