Adding direct shares to your investment portfolio is simple and straightforward. Buying your first shares takes just minutes but becoming a successful investor is a pathway that takes decades.

In this post, we will cover the 5 steps to buying your first shares:

- Understand some basic investing principles

- Open and fund a brokerage account

- Identify something to buy

- Making your first purchase

- Post-purchase paperwork

This page may contain affiliate links. I may hold positions in the investments discussed. See the disclaimer for more info.

Step 1- Understand Some Basic Investing Principles

Before you start, it’s essential to understand why you are risking your hard-earned money.

Understand Why You’re Investing In Shares

Why do investors choose to own shares? Because they want to make money of course!

Owning shares makes you a part-owner of a business. A business is divided up into many smaller pieces called shares- much like a block of chocolate. Owning one share entitles you to one piece of the block. Companies may have millions, even billions, of shares outstanding.

As an investor and shareholder, you own a stake in the business and benefit from its profit and success.

In contrast to investors, traders are speculators who aim to capture short term movements in the share price. Trading requires nerves of steel and not suitable to the temperament of most doctors.

There are two ways to make money:

- Capital gains- you sell your shares at a higher price than you paid to acquire them

- Dividends- the company makes a profit and pays a dividend to its shareholders. In Australia, these are typically distributed every six months. Not all profitable companies pay dividends.

What is the Stock Market?

The Australian Securities Exchange (ASX) is the marketplace where buyers and sellers come together in a regulated environment.

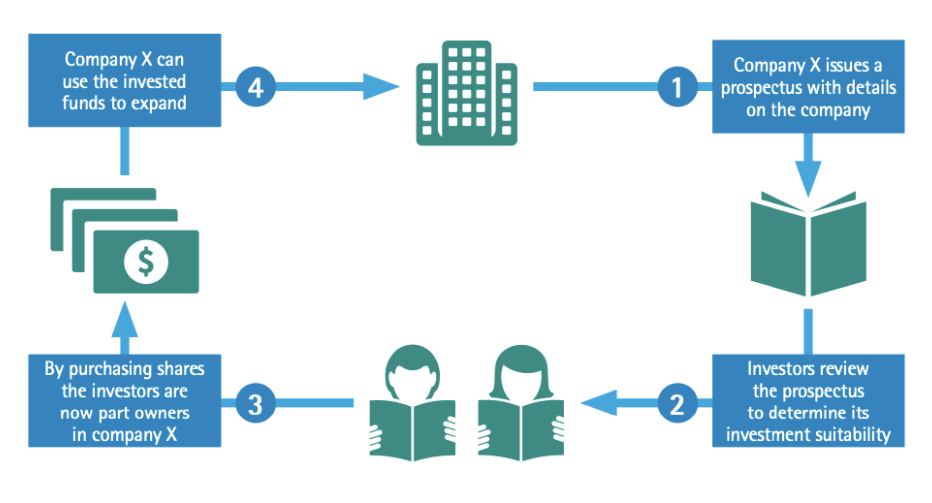

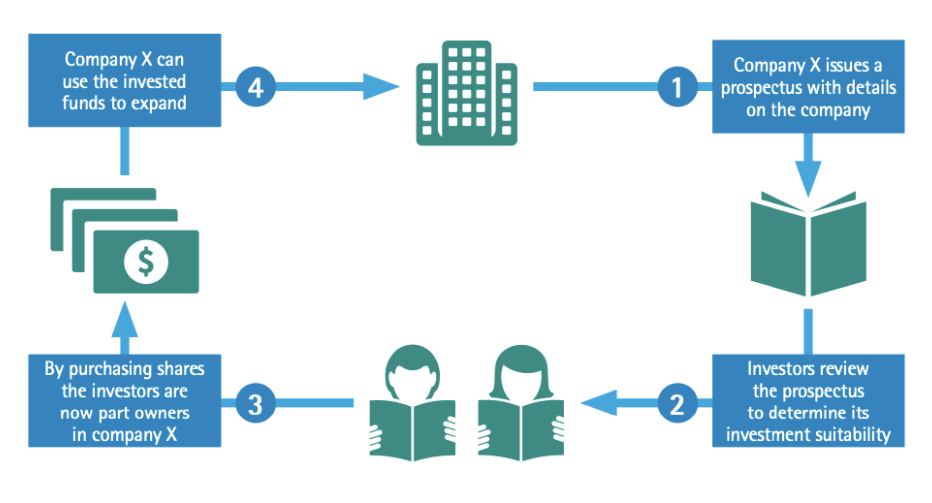

Businesses that want to make their shares publicly tradable register, or “list”, their company on the ASX. The image below shows how a company gets listed on the ASX.

Unlike a fish market or farmers market, there is no physical exchange of produce on the stock market. In this digital age, all the transactions are recorded in a register called CHESS (Clearing House Electronic Subregister System).

In 2021 the current CHESS will be replaced with blockchain technology.

Important Considerations Before You Invest In Shares

Only invest with money you don’t need today. Don’t invest with money that you need to pay the bills or put food on the table. This is to protect you from being forced to sell your shares in a market correction and lets you sleep much better at night.

The money you invest in shares should be set aside for a long term investment with at least a 7-10 year horizon. Investing with a long term perspective protects your profits from being eaten away by brokerage fees and can allow you to accumulate significant amounts of wealth.

Pay off your credit card debt before you invest in shares. The return from shares over the long term is 8-10%, and you’ll need to pay tax on these profits. The interest rate on credit cards are typically around 20%, and this is paid with your after-tax money. Clear your credit card debt before you put money into shares.

Be prepared for the value of your shares to drop or turn to zero. The share market is volatile, and although the long term trend is upward, there will be periods where the value of your shares falls significant. You need to be able to stomach this with conviction and avoid the urge to sell out. There may also be extended periods where the share price goes sideways in a trading range. Depending on what you decide to buy, there is always the chance you could losing everything.

Understand your financial goals. Are you planning for retirement? Children’s private school fees? Or planning to buy a home? How much of your money are you willing to risk on shares? Shares are volatile, and you don’t want to have a significant drop if your funds are needed elsewhere.

Investing is the process of increasing your purchasing power over a period of time- typically one market cycle of 7-15 years.

If you are not investing with a long term horizon (7-10 years) you are trading, speculating or gambling. There is no problem with that but be prepared for some sleepless nights and peptic ulcers.

If you have money to invest, cleared your credit card debt and prepared your stomach for a total loss, then its time to find something to buy and a broker to make it happen.

Step 2- Open and Fund a Brokerage Account

To buy shares you will need to open a brokerage account. Each of the Big 4 banks has share investing services attached to them. Other popular platforms are SelfWealth, Interactive Brokers and CMC Markets.

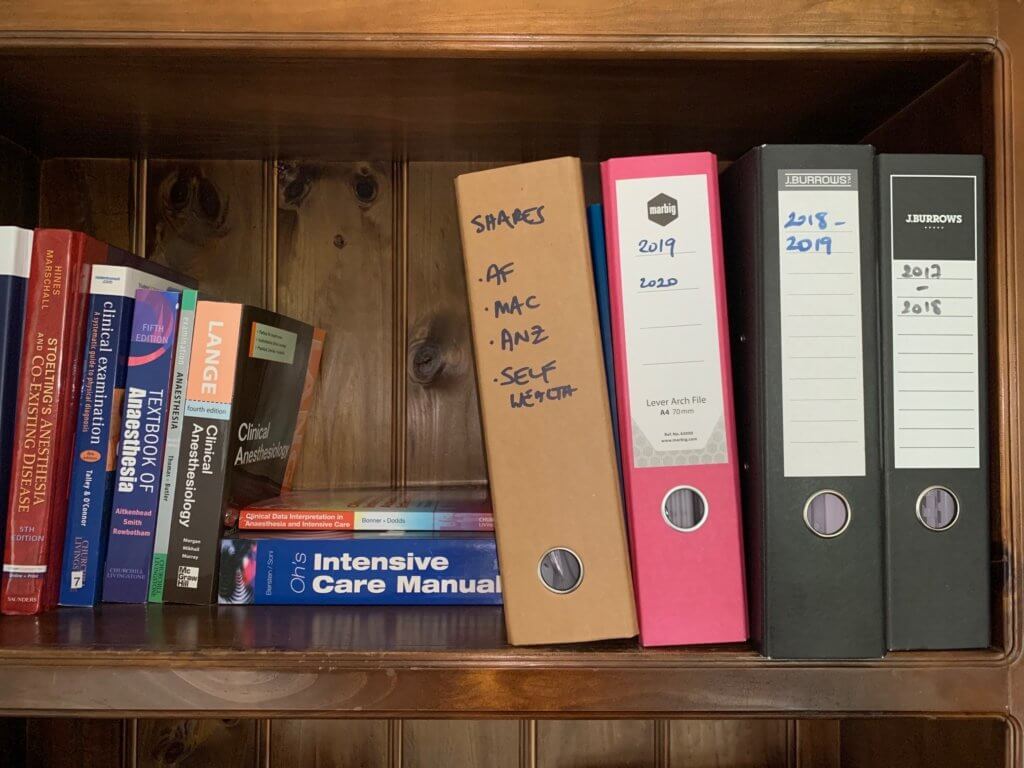

Opening an account takes just a few minutes to fill out the small stack of forms and verify that you understand the risks associated with owning shares. An account can usually be opened in just a couple of days. You can open multiple brokerage accounts. I personally have accounts with Commsec, ANZ, Macquarie and Self Wealth.

Once you have opened an account, you will need to transfer funds into the brokerage account either by direct transfer or BPAY.

Selecting a Broker

There are 2 primary considerations to make when selecting a broker- Advice & Fees.

Advisory or Non-Advisory Broker?

Do you want to get advice about your share investments or are you happy to go alone?

Advisory brokers can play the role of a portfolio manager and guide you through your investment decisions. They can help with stock recommendations, asset allocation and portfolio rebalancing. Of course, this comes at a cost as you will need to pay a premium for their time, research and expertise.

I personally have an advisory portfolio manager for part of my share investments. We review my portfolio quarterly, and he charges me about 1% of my portfolio value as an annual fee. The portfolio has a high growth exposure and a 20+ year investment horizon. I find his insights useful and he sends me new investment ideas. He can place buy and sell orders on my behalf, or I can activate them myself.

Non-advisory brokers enable you to buy and sell shares independently. You don’t pay for any advice or management and can freely trade shares online, via an app or over the phone. All four of the big banks (ANZ, Commonwealth, NAB, Westpac) have non-advisory broker services.

Though there is no personal advice, they usually include charting functions, research tools and company analysis from Morningstar. There are also community chat boards that can help uncover new investment ideas.

Fees

There are 2 main fees you need to consider- transaction fees and account maintenance fees.

Transaction fees

Each time you buy and sell shares, you will incur a brokerage fee.

Some key points regarding transaction fees:

- Advisory brokers typically charge higher transaction fees than non-advisory brokers.

- The big four banks typically have a reduced transaction fee if you also have a bank account with them. E.g. with Commsec a $10,000 with cost $19.95 if you have a Commbank account but $29.95 if you’re with another bank.

- Trades made over the phone are more expensive than those made online.

- On a $10,000 trade, you can expect to pay between $9.50 to $19.95 with a non-advisory broker.

Self Wealth is a new and popular platform with a flat fee of $9.50 per trade.

Account Maintenance and Subscription fees

These fees are to keep your account active. The big four banks do not charge a maintenance fee on their basic accounts.

CMC Markets charges a dormancy fee of $15 if you don’t trade for over 12 months.

Most brokerage platforms also have upgraded services for live data, SMS alerts, research and charting that will attract a monthly fee.

You can see Canstar’s online broker rating here.

Other Considerations:

Counterparty risk– many share trading accounts are CHESS Sponsored. This means that when you buy a share, it is allocated to your individual Holder Identification Number (HIN). Some platforms eg micro-investing apps have custodial accounts. This means they own shares on your behalf. Though they have protection measures in place, there may be implications for you if they go bankrupt.

Funding transactions– some brokers like Self Wealth require you to deposit money into the account before you can make a purchase. A transfer takes 2 days to clear which means you might miss out on a fast-moving stock. Commsec allows you to buy Australian shares and only requires funds 2 days later. If your trading account is with the same bank as your savings account, you can usually transfer funds instantaneously. This way you can sit funds in an interest offset account until you want to make a purchase rather than having funds idling in the share trading account.

Step 3- Identify Something To Buy

What shares should you buy? That is the $88 million question.

There are over 2000 companies listed on the ASX and hundreds of Exchange Traded Funds (ETFs).

What you choose to buy is based on your investment strategy.

There are 2 main strategies- Passive and Active.

If you choose to be passive, then a broad-based ETF might be a good start- checkout my Passive Portfolio where I invest $2,000 every month in VAS and IVV. You can also read my articles on ETFs and Listed Investment Companies (LICs).

If you are keen to be more active, spend time doing research and put in regular work to maintain and balance your investment portfolio, then buying direct shares in companies might be for you.

Remember to do your own research and only invest money you don’t need to live on.

It’s also a good idea to start with an ETF or one of the top 200 stocks, which tend to be less volatile. There’s nothing worse than investing in a penny stock and seeing the share price fall 50% straight after you bought in.

Getting Educated

There is a vast range of available resources.

The ASX has a great resource centre with free online courses about shares and ETFs.

Your brokerage platform will have a lot of useful information about portfolio strategy and construction.

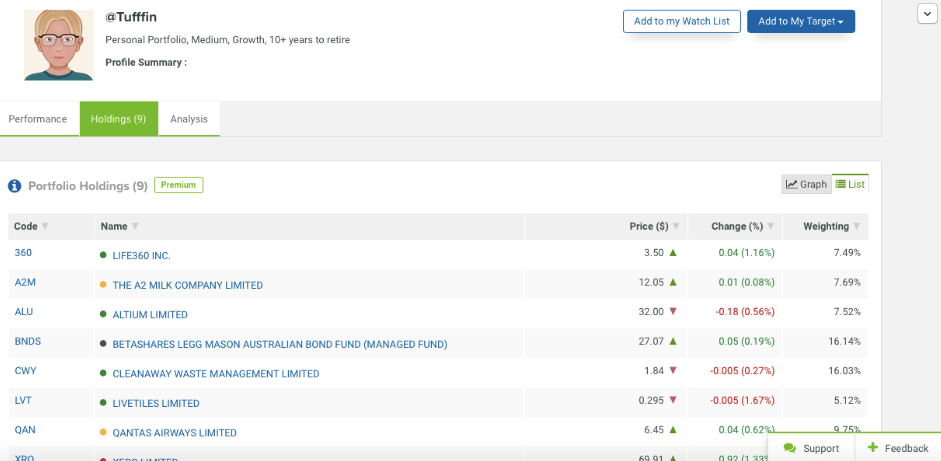

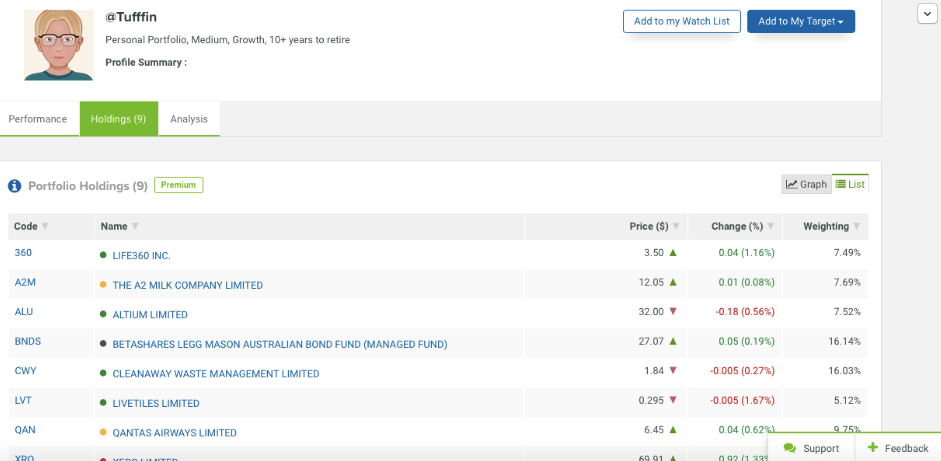

Self Wealth lets you see the performance of other members as part of their premium subscription which you get free access to for 90 days.

You can also see the investments owned by other members and their portfolio exposure.

Step 4 – Making Your First Purchase

Buying your first shares will feel scary, but at some point, you will need to pull the trigger. Remember, you can’t lose more than what your investment (unless you are crazy enough to use leverage with your first purchase).

My dad has read the paper cover to cover every day of my life. He’ll tell me how BHP is making heaps of money due to the weak Aussie dollar, but even after nearly 50 years, he has yet to open a brokerage account and make a single purchase. Experience and success only come from taking action.

Most brokerage accounts have a minimum purchase of about $500. There are platforms like Commsec Pocket that allows you to buy with just $50, but the brokerage costs at $2 (4% of $50) per purchase will eat a large percentage of capital.

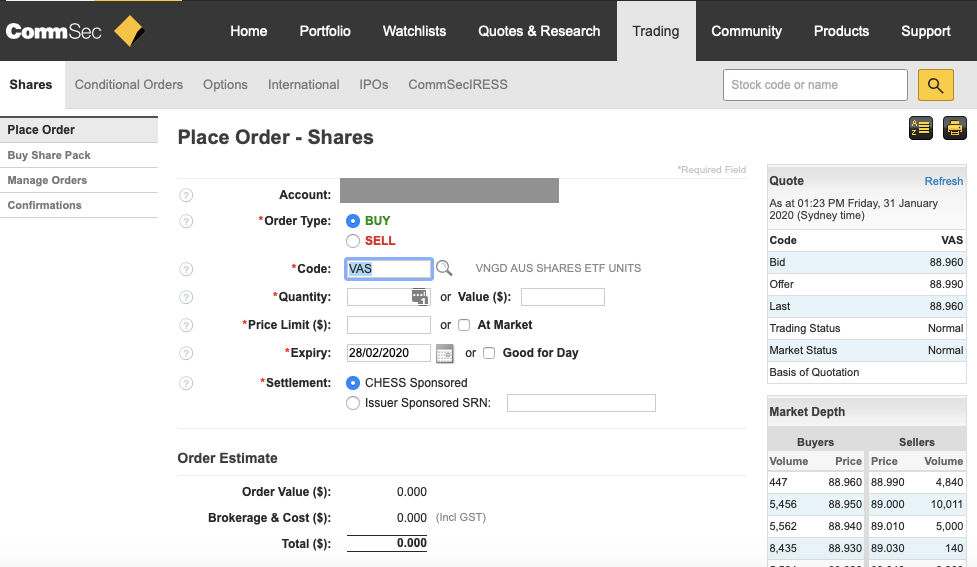

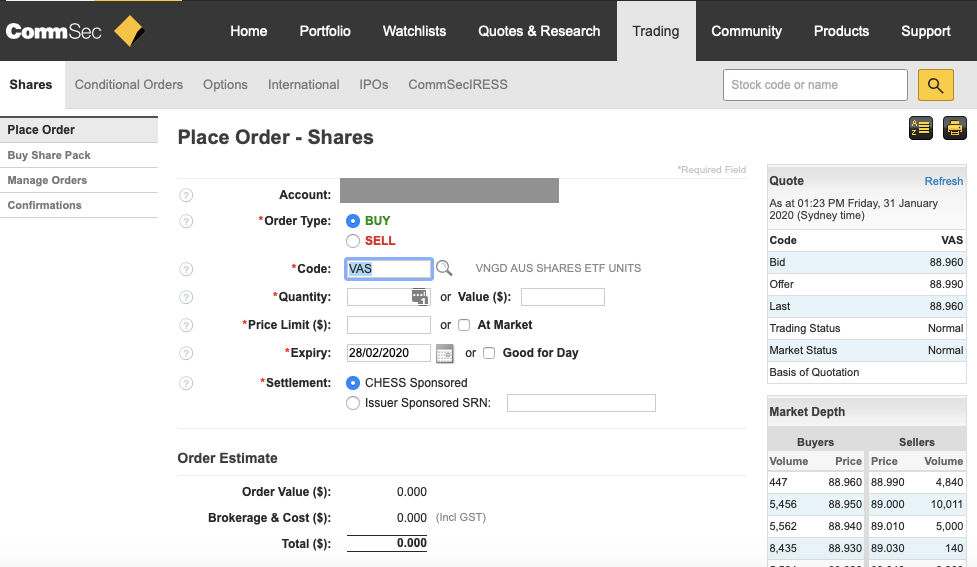

Once you’ve selected the shares you want to buy, you will need to place a buy order. There are 2 types of buy orders- market order and limit orders.

Some basic definitions:

Bid price- the price a buyer is willing to pay

Offer or ask price- the price a seller is willing to sell

Last price- the price of the last sale

Spread- the difference between the bid and offer prices

Market order- if the market is open, a market order will purchase your shares at the current offer price- the price an existing shareholder is willing to part with their shares. This could be higher or lower than the last traded share price. If you are buying into the top 200 stocks as a long term investor, the difference of a few cents is not likely to affect your long term returns.

For example, assume the market is open and ABC Company shares have an offer price of $1.00. If you place a market order, you will pay $100 for your shares (provided enough shares are offered at that price).

Limit order- this is the maximum price you are willing to pay per share.

For example, say ABC Company has an offer price of $1.05 but you only want to pay $1.00 for shares in the company. You can place a limit order which will only purchase shares for $1.00 or less. This has the benefit of capping your purchase price, but you will miss out if the share price moves up quickly and your order goes unfilled.

If you are not ready to pull the trigger just yet, you can try your hand at the ASX sharemarket game.

Just like you can’t become a great doctor by reading a textbook, there is nothing that can fully replicate what it’s like to actually own shares and deal with the emotions of a falling share price. At some point, you have to pull the trigger. If you want to learn how to swim, at some point you have to get wet.

Step 5 – Post Purchase Paperwork

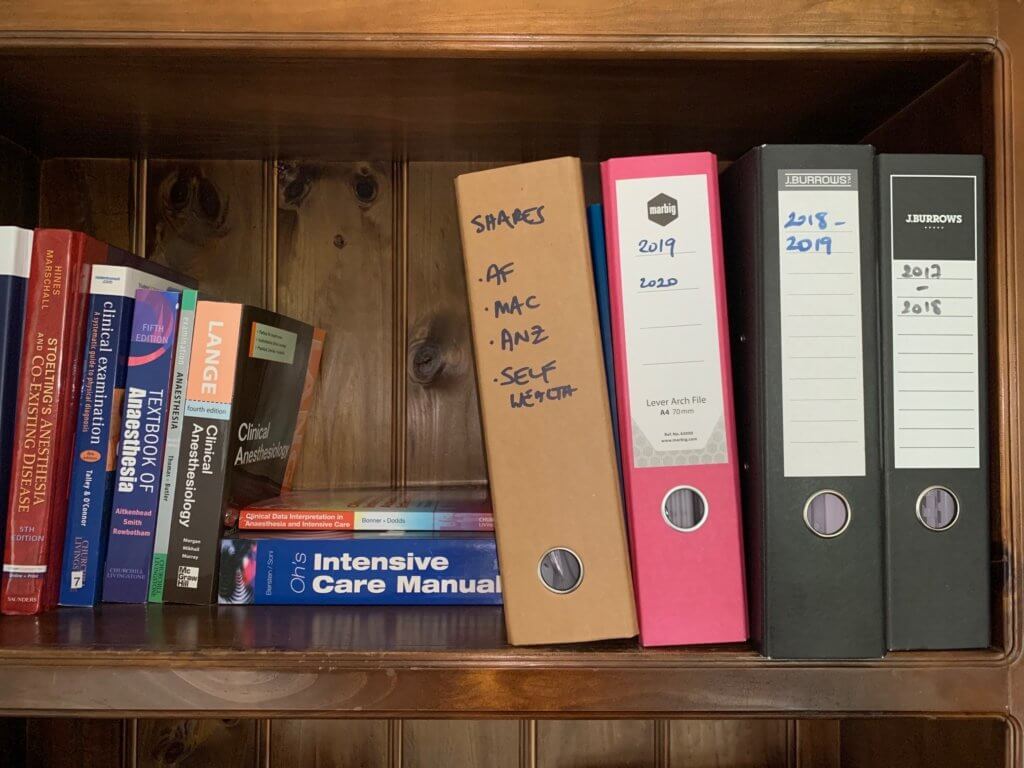

You must be organised in keeping track of your share purchases because there will be tax implications for your dividends and capital gains.

Register Your New Shares

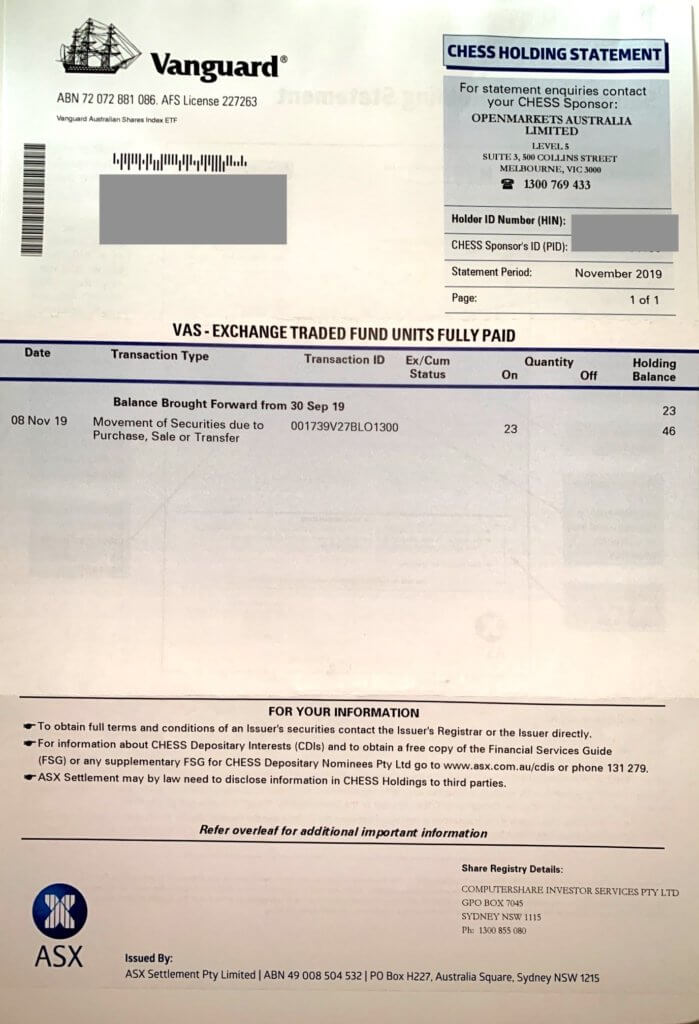

If your brokerage account is CHESS Sponsored your will have a Holder Identification Number (HIN) or Securityholder Reference Number (SRN) which is attached to your share purchases. If you have a custodial brokerage account you may not receive the paperwork discussed below and should discuss this with your broker.

Registering your new shares is like registering a new car.

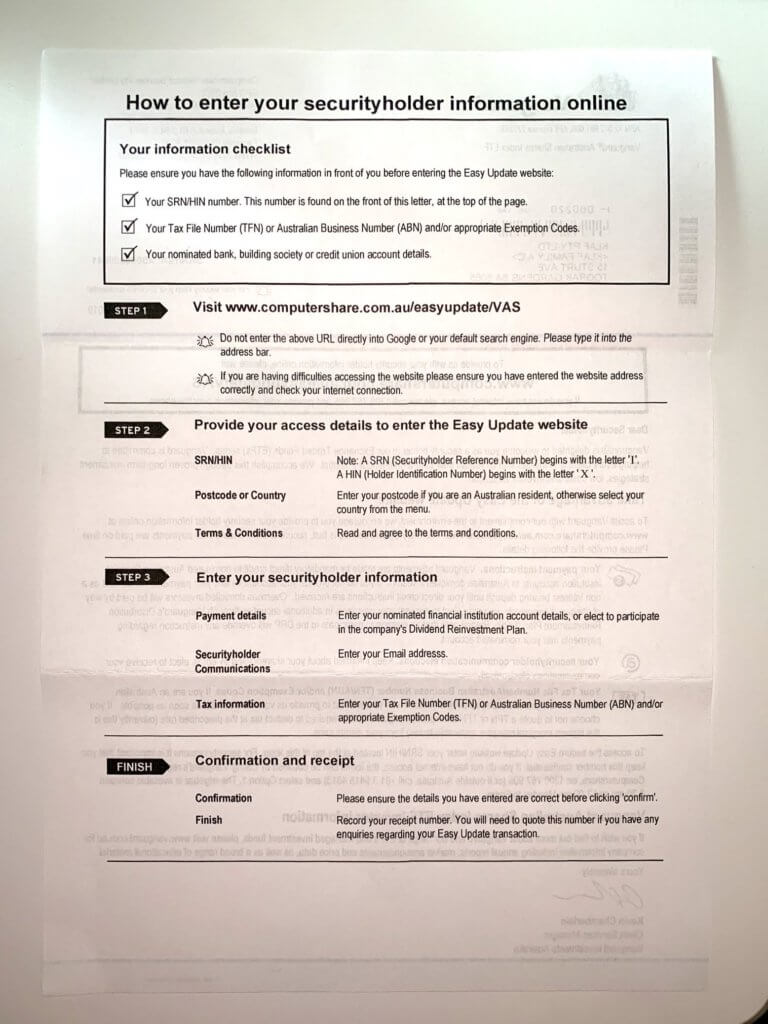

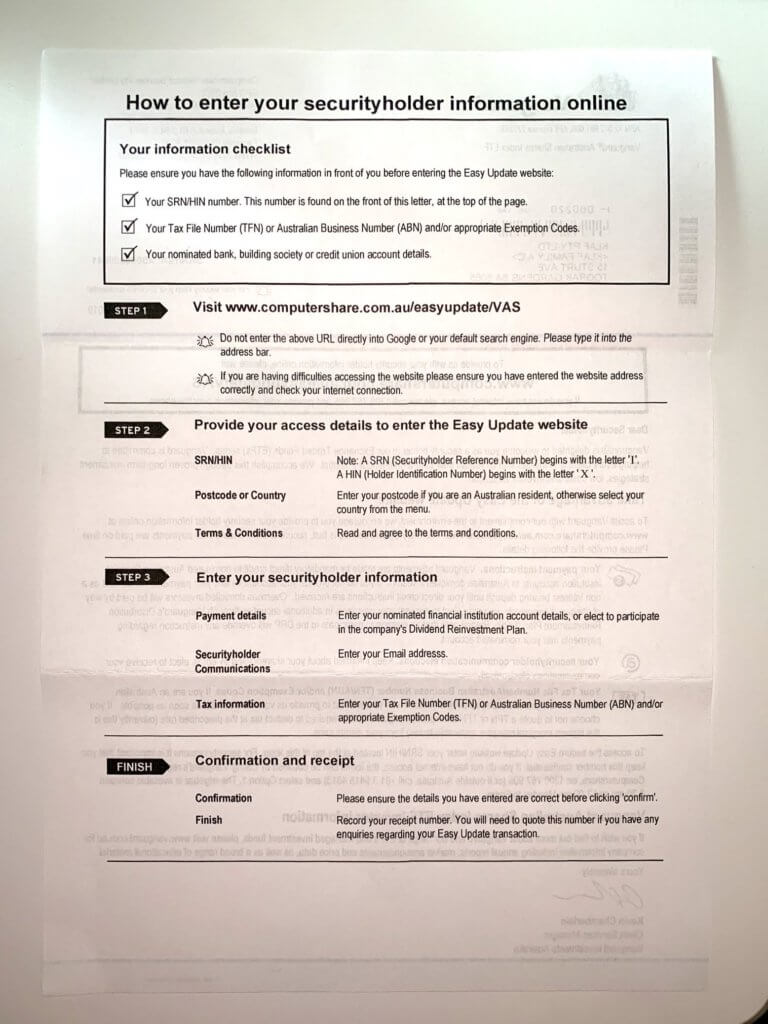

After your share purchase, you receive two letters in the mail. Make sure you keep these in a safe place.

One shows you the company and number of shares purchased.

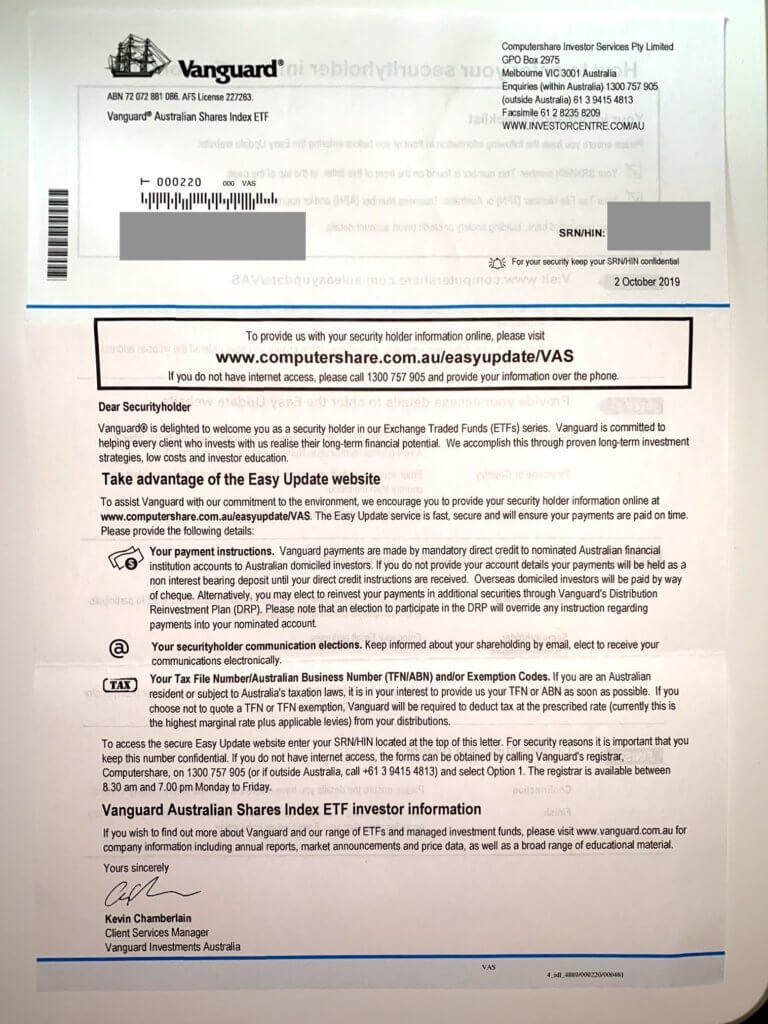

The other is a welcome letter from the business you just invested in. It will also tell you to register your new shareholdings with the company’s chosen share registry. This is usually a third-party provider like Computershare or Link Market Services.

The share registry takes care of shareholder relations.

You need to register your contact information, Tax File Number or Australian Business Number (if you don’t provide these you’ll be taxed as a non-resident) and payment instructions for receiving dividends. You may also be able to opt into a dividend reinvestment program (DRP) if it’s offered. Rather than receiving payment in cash and being able to spend it, taking part in a DRP is a way to compound your wealth over time. You can’t spend what you can’t see.

Tax Laws and Shares

The tax laws are always evolving, so it’s essential to check your situation with your accountant. The profits on shares are treated differently if shares are owned in your personal name, company, trust, or if you are deemed to be a trader. These are the general principles for shares invested in your own name.

Dividends- these are treated as assessable income and taxed at your marginal tax rate. Australia has the unique situation of having “franking credits” which has been in place since 1987.

The idea is to avoid a double tax. The company has already paid tax on profits before distributing dividends to shareholders. Shareholders should get some credit for this tax already paid in the form of imputation credits. The calculation of imputation credits is complicated but can result in a reduction of your tax bill or even a refund. You can read a more detailed explanation and use the franking credit calculator located here.

You are still liable for tax on dividends if you have chosen to take part in a dividend reinvestment program.

Capital gains

Selling your shares for a profit will incur capital gains tax. The capital gain is the money received from the sale of shares minus the cost of purchasing the shares.

If you have bought shares in your personal name and hold them for more than 12 months, you may get a 50% concession on the capital gain. Capital gains are allocated to the financial year in which the sale of shares was made.

Capital Losses

If you sell your shares for less than what you paid to acquire them, then these losses can be set aside to claim against capital gains from shares. They can be carried forward to future financial years. Capital losses cannot be applied to your ordinary income as a tax deduction.

The ATO explains how to calculate your capital gains and losses here.

Further reading and education for first time investors, head over to the ASX website.

As always:

If you learnt something, share this post.

If you’ve got something to share, leave a comment.

If you have feedback, send me an email.

#DYOR

Like with any investment- do your own research before putting your hard-earned money on the line.