My Index ETF Investment for the Long Haul – VAS and IVV.

This page may contain affiliate links. This is not financial advice and you need to do your own research and consult professional advice prior to making any financial or investment decision. I may hold positions in the investments discussed. See the disclaimer for more info.

Since January 2019, I’ve been focussed on investing and personal finance education- I even obtained my Diploma of Financial Planning.

After months of solid learning, and amidst a potential passive investing bubble, I’ve decided to allocate a portion of my portfolio into broad-based exchange-traded funds (ETFs).

The aim is to take advantage of long term growth in the share market by dollar-cost averaging over the next 20 years. Index ETFs offer low fees and portfolio diversification.

Enter the “Passive Portfolio”.

The portfolio is split equally between the Australian and US markets. Australian shares offer good dividend income (4+% vs 1.5-2%) and have the benefit of franking credits. US companies tend to have better long term share price growth and significant amounts of their income is derived globally.

The Passive Portfolio is held within a discretionary trust so that in retirement I can live off the dividends or sell down my holdings. When I’m not around any longer, ownership easily passes on to my children. Because the portfolio is “self-cleansing”- I don’t need to worry about companies going out of business.

Having looked into index funds and exchange-traded funds (ETFs), I decided that ETFs offers me liquidity, lower management fees and ease of purchase. Unfortunately, they don’t have automated direct debit facilities like index funds.

For brokerage, I’m using Self Wealth because they have the lowest transaction fees- capped at $9.50 per transaction. If you want to get 5 free trades (and give me 5 free too) with Self Wealth then use this link

The Plan

1. Every month, for the next 20 years, invest $2,000 in passive ETFs- rounded to the nearest share. Over 20 years, this is a total input of $480,000. At a conservative compounded rate of 8% per year over 20 years this will compound to over $1,000,000.

2. Alternate between Australian and US ETFs.

In odd months (January, March, May, July, September, November) invest in the Vanguard Australian Shares Index ETF (VAS).

In even months (February, April, June, August, October, December) invest in the iShares S&P 500 ETF (IVV)

3. There is no specific date during the month when the funds will be invested- I’ll do it when it’s convenient.

4. Reinvest all dividends using the dividend reinvestment plan.

5. Never sell holdings within the portfolio- even if the market falls through the floor and I start feeling sick.

6. Track the portfolio monthly and update it in this post and document the amount invested, the portfolio value and gain or loss.

Answering some obvious questions….

Why Did I Choose VAS?

I chose VAS because it tracks the ASX 300, giving it slightly more exposure than the other ETFs which tend to follow the ASX 200. Its management expense ratio (MER) is 0.1%, and it has been in existence since 2009. It’s also the biggest, has a good track record of returns and a dividend reinvestment program.

Other ASX broad-based ETFs are STW, IOZ, MVW and A200.

This article describes six factors to consider when choosing an ASX broad-based ETF.

Why Did I Choose IVV?

IVV has been domiciled in Australia since 2018, which gives two significant benefits. The first is the dividend reinvestment plan. The second is there is no need to fill in those dreaded W-8BEN forms for US tax withholding. It tracks the S&P 500 and has a MER of just 0.04%. While units are purchased in Aussie dollars, their value is exposed to currency fluctuations with the US dollar. That’s just part of investing in overseas markets.

The other popular broad-based US ETF is VTS but it doesn’t allow dividend reinvestment.

Here’s a good article that discusses global share ETFs.

Why Did I Choose $2,000 per month?

To reduce the cost of brokerage. If I was to do $1,000 in both VAS and IVV, then the amount eaten by brokerage fees is $19 or near 1%. By alternating monthly investments, I’ve halved my fees but retain similar dollar-cost averaging benefits. The amount of $2,000 is also an amount I can afford to invest passively every month.

Why Did I Choose Self Wealth?

They offer meager fees, capped at $9.50 per trade. Holdings are also CHESS sponsored- I actually own the shares in the ASX register. This is protection should Self Wealth ever go out of business. The downside is they only allow you to buy Australian listed companies. Get five trades free using my referral link.

I use ANZ Share Investing for my active portfolio because it has access to international shares. I also have a CommSec account that has my original BHP share purchase from 2001.

But Isn’t The Market Due for A Correction?

I’ve been expecting a correction since 2015. Meanwhile, the share market in Australia and the US has rocketed to new highs.

This portfolio is about investing passively for the long term, taking advantage of dollar-cost averaging and minimising fees.

This passive portfolio is just one component of my investments.

As always:

If you learnt something, share this post.

If you’ve got something to share, leave a comment.

If you have feedback, send me an email.

Passive Portfolio Tracking

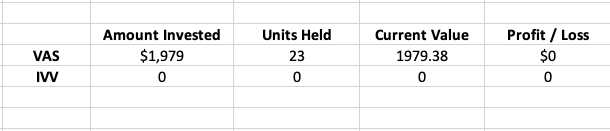

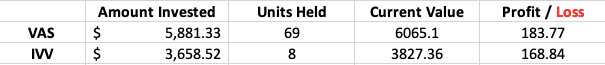

September 2019

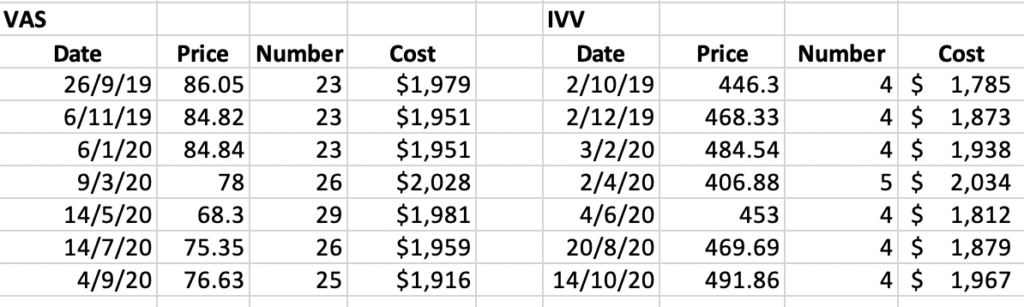

Purchased VAS 23 units @ $86.05 on 26/9/19.

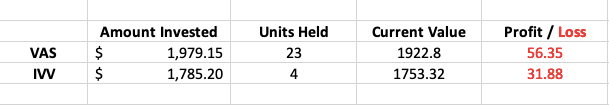

October 2019

Purchased IVV 4 units @ $446.30.

VAS paid a dividend of $24.63. I have opted into the dividend reinvestment program.

November 2019

Purchased VAS 23 units @ $84.82.

December 2019

Purchased IVV 4 units @ $468.33

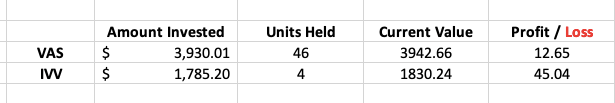

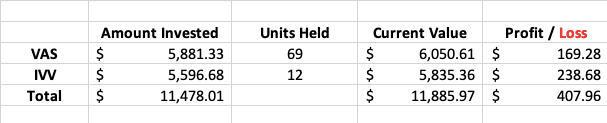

January 2020

Purchased VAS 23 units @ $84.84

February 2020

Purchased IVV 4 units @ $484.54.

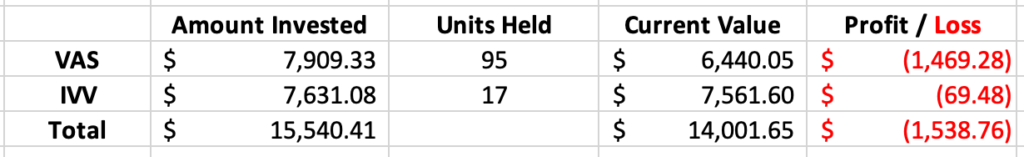

April 2020

Skipped March update but did buy VAS. Massive correction has given the chance to dollar cost average. Passive Portfolio is now in the red.

Purchased VAS 26 units @ $78.00 on 8/3/20

Purchased IVV 5 units @ $406.88 on 1/4/20

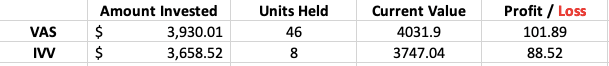

October 2020

Been a bit slack updating this since the carnage of March and starting the podcast.

Dollar cost averaging into these through the slide and rebound has continued to prove profitable.

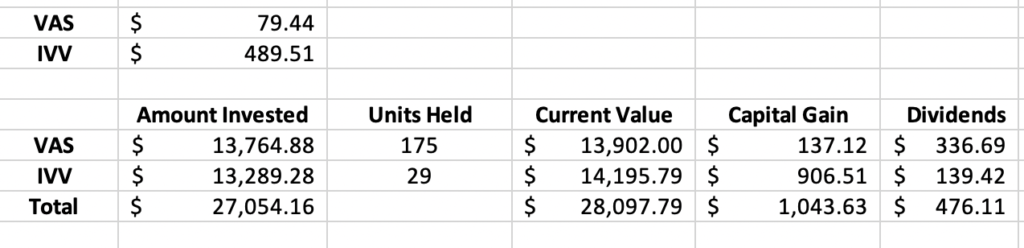

These are the purchases and returns:

Interesting – I am taking a similar approach with medical office buildings, creating a passive income stream. My wife is originally from Australia, her dad always said that was a solid market for investing. He always said his biggest regret in life was not buying real estate out there.

Take care and good luck,

Max