Why you need to invest, my biggest mistakes and where you can put your money to work.

In this post we will discuss:

- what is investing

- the magic of compounding

- investment options

During our childhood, we absorb the money habits of our parents. As we move through life, we add, modify and delete knowledge to suit our circumstances and temperament.

My parents worked hard for every dollar they earned. They fried rice, battered lemon chicken and washed plates seven days a week until I was in my 20s.

They were also gamblers. There were stretches where they’d hit the casino every night for months on end. The roulette, blackjack and baccarat tables attracted them like moths to a flame. They relished the dopamine hit of a win and wallowed when they lost.

All that cooking and gambling left little time to focus on investments. They read the paper religiously from cover to cover, but never did anything to increase their financial literacy.

At retirement, their investment portfolio comprised of the family home and a small parcel of Telstra shares. Being self-employed, they chose NOT to contribute to super, and for some reason, planned to receive the aged pension. After the bills and school fees were paid, the surplus went to the Adelaide Casino.

Their advice to me was “study hard and get a good job…. use your brains so you don’t have to work as hard as us”. They believed that medicine would be a good choice because in their mind, doctors earn a lot of money and that made them rich.

My First Investment

In my third year of Med School, a friend introduced me to Robert Kiyosaki’s book “Rich Dad, Poor Dad”. If you haven’t read it, I recommend you add it to your reading list.

This book opened my eyes to the concepts of investing, passive income and financial freedom. Neither my parents or teachers had ever mentioned you could use

That year, I opened a Commsec account and bought my first shares using

While I still have a long journey to reach financial freedom (thanks 13 years of medical training and kids), those BHP shares are $41 at the time of writing. Their value is up around 400%, and they’ve paid dividends every year.

Income vs Wealth

My parents believed that doctors are rich because they earn a lot of money. The reality is that earned income and wealth are not the same thing.

Earned Income is trading time for money. All that history taking, diagnosing and treating will earn us upwards of $100 an hour- well above the average Aussie and a good reward for all those years of training and exams. Unfortunately, for most of us, the income stops when we stop seeing patients. We’re also limited to 168 hours in any given week.

Compare this with the $149,353 that Amazon’s Jeff Bezos makes every MINUTE– even while he sleeps!

So what does it mean to be wealthy?

Each of us is on a personal financial journey. There are four main stops- survival, surplus, financial freedom and financial abundance.

Wealth begins once we reach financial freedom. We’re financially free when the income we receive from investments is greater than our cost of living. Through smart decisions, our investment portfolio gives us the chance to stop working for money and we can choose to caravan around the country, meditate all day long, or help our

The 3 Principles of Wealth

The wealth journey has just three core principles:

1. Spend less than you make

2. Invest the surplus

3. Use debt wisely

It really is that simple. We need to keep spending in check. We need investments that increase in value. Finally, we need to respect that debt is a double-edged sword- it accelerates time, but magnifies risk.

While we’re unlikely to reach the Income or financial abundance of Jeff Bezos, each of us should aspire to achieve financial freedom through our investments.

How Investments Make Money

Investing is placing bets on a better future.

There are only two ways to make money from your investments.

- Income- you receive interest, dividends or rent.

- Capital gains- you sell an investment for more than you paid for it.

Both of these should then be reinvested to allow our money to grow and compound.

The Magic of Compounding

Albert Einstein is said to have called compounding the greatest force in the universe and the eighth wonder of the world.

Compounding our investments is about using our money to make money babies.

It goes something like this. We work hard and save some money. Let’s call these initial savings our Money Mummy. We take Money Mummy and use her to purchase an investment. After a period of gestation, Money Mummy gives birth to our first money baby- an interest payment, dividend or rent. Unlike human newborns that require years to reach reproductive maturity, money babies are ready to become money mummies from the time they’re born.

We take that first money baby and invest her. In no time, she’s had a money baby of her own. I’m sure you can work out how the story continues.

The best part is that money mummy’s never hit menopause and can create money babies forever! By simply reinvesting every money baby (and not spending them) the value of our initial Money Mummy grows exponentially over time.

Before we know it, the money babies born every year become greater than our initial Money Mummy investment.

My Big Mistakes & Regrets

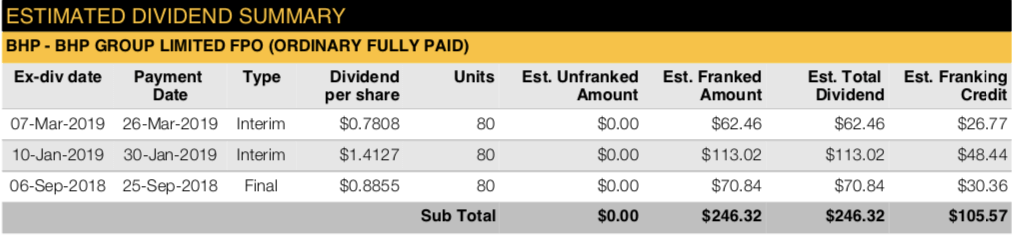

The share price of those BHP shares I bought during Uni has gone up 400% over the past 18 years. That’s an

Not bad for a company that has to keep digging holes and constructing expensive mines.

The dividends over the past year alone were $246 plus a franking credit of $105. Those shares only cost me $738 to purchase, so the current dividend return alone is over 33% on my initial investment.

That is the magic of compounding.

Looking at these numbers, I have two BIG regrets.

The first is I should have continued to buy more shares over time.

The second is that I should have used the dividends to make money babies. It wasn’t until this year that I opted

The most significant gains in investing comes from the immense power of compounding over the long term- make money babies and reinvest them.

The best thing we can do is to start investing early.

The Rule of 72

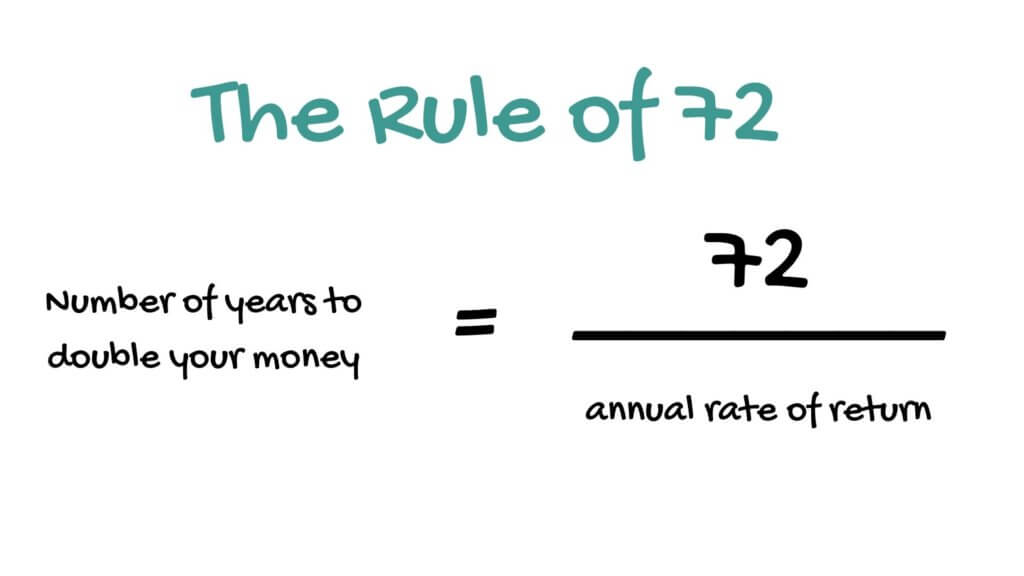

There is a simple rule that calculates how fast you will double your money.

You simply divide your rate of return into 72.

If you get a 5% return on investment, your money will double in 14.4 years (72/5)

If you achieve a 10% return, it’ll double in just 7.2 years (72/2)

If you’re like Warren Buffet and make 20%, you’ll double your money every 3.6 years (72/20)

Investment Vehicles- Where Can You Make Money Babies?

There is no shortage of places to put your money to work. But before you put your money on

There are many ways to classify investments. This is just my way. I separate them into three categories- core, cocktails and alternatives.

Core Investments

In every bar or pub, there are four basic drinks- beer, wine, spirits and soft drinks. Everyone knows that beer is bitter, wine is made from grapes, spirits burn on the way down and soft drinks don’t contain alcohol. Within each category, there’s a variety of options.

This is similar to the four core investment classes:

1. Cash- this is money held in a bank deposit account

2. Fixed Income- the most common are term deposits, government

Cash and fixed Interest are called DEFENSIVE assets because the risk of losing your principal is comparatively low. You are effectively loaning out your money and receiving interest income. The trade-off is that there are no capital gains and your returns are capped.

3. Shares- a share is part ownership in businesses listed on a regulated public exchange like the Australian Stock Exchange.

4. Real Estate- this includes residential, commercial and industrial property.

Shares and real estate are commonly called GROWTH assets because they possess the potential for significant capital gains. They may also produce income from dividends and rents.

The core investment classes have existed for hundreds of years, so many regulations are in place to protect investors. You can invest in these core asset classes directly or get assistance from a money manager.

Cocktails- Managed Money

Continuing with my bar analogy. Today you’re at the bar and in the mood for something different. Rather than just getting a glass of red wine, you decide to get a cocktail.

So you call the barman over and tell him you’re looking for something fruity but not too sour. He assures you he has just the drink for you and places a special glass on the bar. Tapping into years of experience, he pours a combination of the basic drinks into a silver shaker, adds ice and before you know it a delicious drink sits on the countertop. By blending basic ingredients he’s created a totally new experience and charges you a fee for his time, knowledge and theatre.

Cocktails exist in the investment world too- they’re called managed funds. Here, the bartender is replaced by a fund manager.

There are many different types of managed funds. The most common are:

- Index funds

Exchange traded funds (ETFs)- Listed investment companies (LICs)

- Unlisted managed funds

You hand over

The investment philosophy of the fund may be to invest in an index, a sector, a country or a theme like artificial intelligence, cybersecurity or renewable energy.

Index funds and index ETFs have become extremely popular because of their low fees. You can use Morning Star to compare the performance of ETFs and LICs.

But there’s even more…

Exotic Investments

Exotic, or alternative investments allow you to diversify your investments. There is potential for huge profits in this area, but this is often associated with less liquidity, higher volatility and regulation than the core investment classes.

If Core Investments are the dogs and cats of the investing world, Exotic investments are the tigers and lions. It’s cool to get up close but you better be ready to run for your life and you should be ready to lose a limb or two.

If you are going to play in this arena, make sure you understand the issues of liquidity, volatility, regulations and downside risk.

The number of available alternative investments is endless, but here are some common ones:

- Hedge Funds

- Private Equity

- Startups, Venture Capital & Angel Investing

- Commodities

- Derivatives- options, futures, contracts for difference (CFDs)

- Foreign exchange (forex)

- Cryptocurrency

- Peer 2 Peer Lending

- Collectibles- wine, coins, art, cars

Diversification

There is the old saying that you should “Never put all your eggs in one basket”.

Diversification across asset classes and within asset classes allows you to reduce downside risk and increase your potential returns.

For example, if you had all your money in shares of just one company, a sell-off could decimate your net worth. Conversely, holding all your money in cash will mean that the buying power of your money is eaten away by inflation.

We all need a diversification strategy that suits our risk tolerance, investment horizon and need for liquidity and access to cash.

So what did your parents teach you about money?

My parents taught me the value of hard work and I got to witness what happens when you mix gambling and the absence of an investment plan. Because of this, I’ve pledged to improve my financial literacy, to build an investment portfolio that sustains

Takeaways from this Post:

- investments make money from income and capital gains

- use your money to make money babies and harness the effect of compounding

- you can invest in core, cocktail and exotic investments

- diversify your investments

As always:

- If you learnt something, share this post.

- If you’ve got something to share, leave a comment.

- If you have feedback, send me an email.

One Reply to “The Basics of Investing”