Build wealth over time through with regular and consistent investments.

This page may contain affiliate links. I may hold positions in the investments discussed. See the disclaimer for more info.

What Is Dollar Cost Averaging?

Dollar cost averaging is an investment strategy where the same amount of money is invested consistently over time regardless of market conditions.

Through discipline and avoidance of emotion-driven decisions its a proven wealth accumulation strategy.

The method can be applied to the purchase of shares, index funds, exchange traded funds and listed investment companies.

The Advantages of Dollar Cost Averaging

- Removes emotion from the decision-making process

- Eliminates market timing risk

- Buy more shares when prices have gone down

- Most effective in a down-trending market by reducing the average price paid

- Invest with small amounts of money

- Consistent portfolio growth over the long term

- Reducing risk when a lump sum is available

Dollar cost averaging is just one investment strategy but depending on your appetite for risk and desired returns; it may not be the best one for you.

The Share Market Has An Upward Bias

Over the long term, the stock market has a long, or upward bias with gyrations along the way.

Because we are unable to pick tops and bottoms accumulating shares regularly and independent of the price is a valuable wealth accumulation strategy.

We all want to buy low and sell high, but none of us has a crystal ball.

Our best bet is to invest for the long term with the expectation that over decades, our assets will increase in value.

Two Scenarios For Dollar Cost Averaging

There are are two scenarios that typically face investors. The first is investing with “Fresh Funds”- you save and regularly invest those funds. The other second is if you have received a “Lump Sum” from an inheritance, bonus or windfall.

To begin, let’s focus on dollar cost averaging with Fresh Funds.

How To Dollar Cost Average In The Share Market

To take advantage of dollar cost averaging you need three things

- An asset to purchase

- A set of amount of money to invest regularly

- A regular timeframe for buying the asset, e.g. monthly, quarterly or annually.

In September 2019, I started my Passive Portfolio which dollar cost averages into Australian and US ETFs. You can follow my results here.

In this portfolio, I invest $2,000every month.

In odd months (January, March, May, July, September, November), I invest in the Vanguard Australian Shares Index ETF (VAS).

In even months (February, April, June, August, October, December) I invest in the iShares S&P 500 ETF (IVV)

Over the next 20 years I will have invested $480,000 ($2,000 x 240 months). At an 8% rate of return, this should amount to over $1 million in 20 years.

How Does Dollar Cost Averaging Fare in Bull and Bear Markets?

In my post called Investing Basics, I wrote about my first purchase of BHP shares back in 2001. I bought 80 shares at $9.23 for a total cost of $738 plus brokerage.

I didn’t add to them and didn’t reinvest the dividends. Eighteen years later, those shares are now worth about $3,000. Last financial year it paid a dividend of $246 with a franking credit of $105.

But what if I had dollar cost averaged into BHP every year?

BHP is the world’s biggest miner and a great Australian success story.

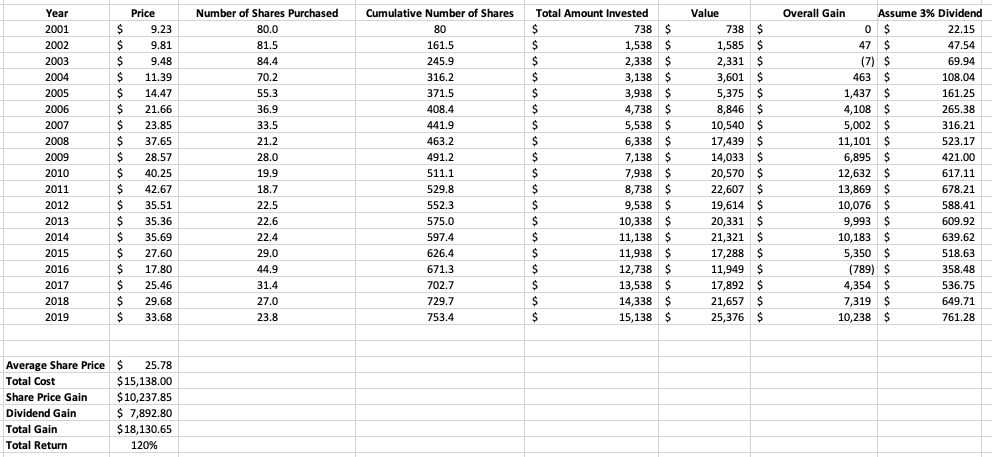

The table below shows how an investment of $800 on the first trading day of every year since my initial purchase in 2001 would have turned out.

I have not included the costs of brokerage.

Would We Win, Lose or Draw By Dollar Cost Averaging?

Gains come from the combination of the share price increase and dividend payouts.

Share Price Gains- Overall, I would have invested $15,138 with an average share price of $25.78. The value at January 2019 would be $25,376. The price derived gain is $10,238 or 68%.

Dividend Gains- BHP consistently pays dividends though this varies from about 3%-5%. If we assume a conservative 3% dividend payout, the cumulative dividend return is $7,892.

Total Gains- $18,130 or 120% of total investment.

Overall a 120% gain over is not incredible compared to other shares. But remember that the investment was staggered in over time- not a lump sum invested back in 2001.

Over 18 years, BHP has gone through a range of economic cycles. It rode up during the commodities boom, took a hit in the GFC and has survived the commodities bust that began in 2015.

Many analysts are expecting the BHP share price to increase over the next 5 years as the developing world, particularly India, sees massive infrastructure growth.

Bull Market Performance

The period of 2001 – 2008 was a great bull market for commodities. China was building infrastructure and skyscrapers at a crazy pace, and BHP benefitted immensely.

As the share price rose, we can see that the number of shares our $800 investment could buy each year dropped from 81 in 2002 to 21 in 2008.

However, the gains were huge.

In 2008, after only eight years, we would have seen our investment increased by 75% based on share price alone.

Bear Market Performance

As all those subprime mortgages toppled the investment banks and sent the US into recession in 2008 share prices across the globe took a hit. BHP fell about 25% but recovered to peak in 2011.

Then from 2011 – 2016 BHP lost about two-thirds of its value going from mid $40’s down to mid-teens. The reason is multifactorial, but falling commodity prices and reduced global demand were partly to blame.

During that period, all the gains of the previous nine years evaporated and we entered negative return territory.

But since 2016, its share price has rebounded and doubled in the last three years.

By dollar cost averaging over time, we would have accumulated a sizeable number of shares and built a very tidy dividend-paying cash machine.

How About Investing A Lump Sum?

So far, we have walked through dollar cost averaging using fresh funds- money you save and invest on a regular basis.

But what if you suddenly received a lottery win, inheritance or massive paycheck bonus of $1 million?

Should you invest it all as one lump sum? Or should you spread out your investments into smaller parcels, e.g. invest $83,333 a month for 12 months?

Historical data suggests that the returns are more likely to be better off if you of invest it in a lump sum rather than spreading it out over 12 consecutive months.

But investing is a personal decision based on two significant variables that are unique to each individual- risk tolerance and investment horizon. If you’re investing for 50 years and have no problem seeing your account fall significantly, you can invest in a lump sum and save on brokerage. Alternatively, if you are cautious because of market conditions or inexperience, then a

Using our BHP example above, if you had put all your money into the market in 2011 at its $43 peak, you would currently be down about 20%. Conversely, if you went all-in at $14 in 2016, you’d be up over 250%.

We can only see the peaks and troughs in hindsight.

But Aren’t We Heading for a Recession?

A lot of attention has focussed on the yield curve inversion- the return on long term (10 year) US treasury bonds is now below the return on short term (2 year) bonds. This phenomenon has predicted every US recession which has occurred on average 17 months after the yield curve inversion.

So are you better off moving out of stocks and into bonds given the predicted recession? Fama and French say no. In August 2019, Nobel Laureate Eugene Fama and Ken French showed you are better off staying in stocks in the paper “Inverted Yield Curves and Expected Stock Returns.”

Takeaways

- Dollar cost averaging is one effective strategy for wealth accumulation over the long term

- It takes discipline to execute

- Setting aside a regular amount of fresh funds to invest every month removes emotion from the investment process

- If you have a lump sum to invest, the data suggests it better to do a once-off investment rather than dollar cost averaging

See how my Passive Portfolio is going here

As always:

If you learnt something, share this post.

If you’ve got something to share, leave a comment.

If you have feedback, send me an email.

#DYOR

Like with any investment- do your own research before putting your hard-earned money on the line.