Since starting my podcast and interviewing investors like Peter Thornhill, a number of listeners have asked me “how do you invest your money?”

In this post I’ll share with you my Investment Garden.

Disclaimer: This post is not financial advice and you need to do your own research #DYOR. Please seek professional advice before making any financial or investment decision. The page may contain affiliate links. See the disclaimer for more info.

Passive or Intelligent?

One of the greatest books on investing is The Intelligent Investor by Benjamin Graham. Graham was the person who first taught Warren Buffett about investing. These teachings formed the foundation that eventually turned Buffet into the greatest investor the world has ever seen.

Graham describes 2 types of investors:

- The Passive Investor

- The Intelligent (or Industrious Investor)

There are three questions that will help you decide which camp you fit in. To become an Intelligent Investor you have to answer “Yes” to all three.

- Do I want to get better than average returns?

- Do I enjoy investing?

- Do I have the time to research and manage my investments?

Everyone answers “Yes” to question 1. But very few can truly do the same for question 2 and 3.

Passive Investors

There is nothing wrong with going passive. You can still make a lot of money over time by being a Passive Investor.

Passive investors simply come up with their investment strategy, save and invest regularly and hold the investments forever. You will get great returns and save truckloads on brokerage and management fees. You will also have more time to spend with your family and doing the things you love.

A simple approach to passive investing is simply to buy broad-based index funds or listed investment companies (LICs). Warren Buffet has famously said that for the average investor, investing in index funds is the way to build wealth. Berkshire has also recently started buying index funds.

If I were going to put money into an index fund in relatively equal amounts over a 20 or 30-year period, I would pick a fund — and I know Vanguard has very low costs. I’m sure there are a whole bunch of others that do. I just haven’t looked at the field. But I would be very careful about the costs involved, because all they’re doing for you is buying that index. I think that the people who buy those index funds, on average, will get better results than the people that buy funds that have higher costs attached to them, because it’s just a matter of math.

Warren Buffet

Another passive strategy is Peter Thornhill’s approach which is to invest in Australian industrial LICs. You can listen to my interview with Peter here.

By investing regularly, investors benefit from the regular dividend income stream and the capital growth of companies over time.

The keys to being a successful passive investor are to:

- pick a strategy you can stick with

- invest for the long term

- invest regularly

- keep fees to a minimum

So what about becoming and Intelligent or Industrious Investor?

Intelligent Investor

If we want to beat the market we have to be willing to do the work. There are two places that work needs to be done- research and psychology.

On doing research. It amazes me how many investors will spend 2-10 hours researching a new set of wireless headphones prior to making their purchase. But on the flip side, they will hear about a hot new stock at a Sunday BBQ and place their buy order first thing Monday morning. Little more than a few beers and a bowel motion has occurred between the stock tip and the purchase. The money invested is often many orders of magnitude greater than the price of a set of headphones.

It’s the research that distinguishes investing from gambling.

Alas, the greatest work is not in the research, it’s in building our psychology.

Successful investing is more stomach than it is brains. Its the battle between fear and greed or Oh sh!t and FOMO (fear of missing out).

As we have seen from the Corona Correction, human psychology and fear hit the stock market before we reached the peak number of cases and death rate. Similarly, the rapid rebound has occurred before companies have reported their earnings for the first and second quarter of 2020. The lockdown is guaranteed to see profits decimated for most companies.

The reason that most investors fail to beat the market is that FOMO gets them in just before the top and they capitulate and sell at the bottoms. This is totally counter-intuitive if you want to make money.

Thats why the passive approach works so well- it saves us from ourselves.

The Correction has been a great time to buy companies with safe balance sheets, solid earnings history and high operating margins. But during the collapse when thousands were dying in Italy and the US, it was so hard to pull the trigger and buy stocks when most of our portfolios were drowning in a sea of red.

The keys to becoming an Intelligent Investor are:

- create a strategy you can commit to

- invest time to research

- be ready to say “no” to many opportunities

- invest time to manage your portfolio

- train your stomach to deal with the bipolar nature of Mr Market

- be ready to pull the trigger when the opportunity arises

As any striving Intelligent investor knows, it’s easier said than done.

My Investment Garden

So which type of investor am I?

I take lessons from both because I am willing to spend time building my knowledge but I also see the merits of holding index funds and LICs for the long term. The learning process is enjoyable for me. Crazy huh? I also like to put money into new ideas because unless I have skin in the game, the news and chatter is just noise.

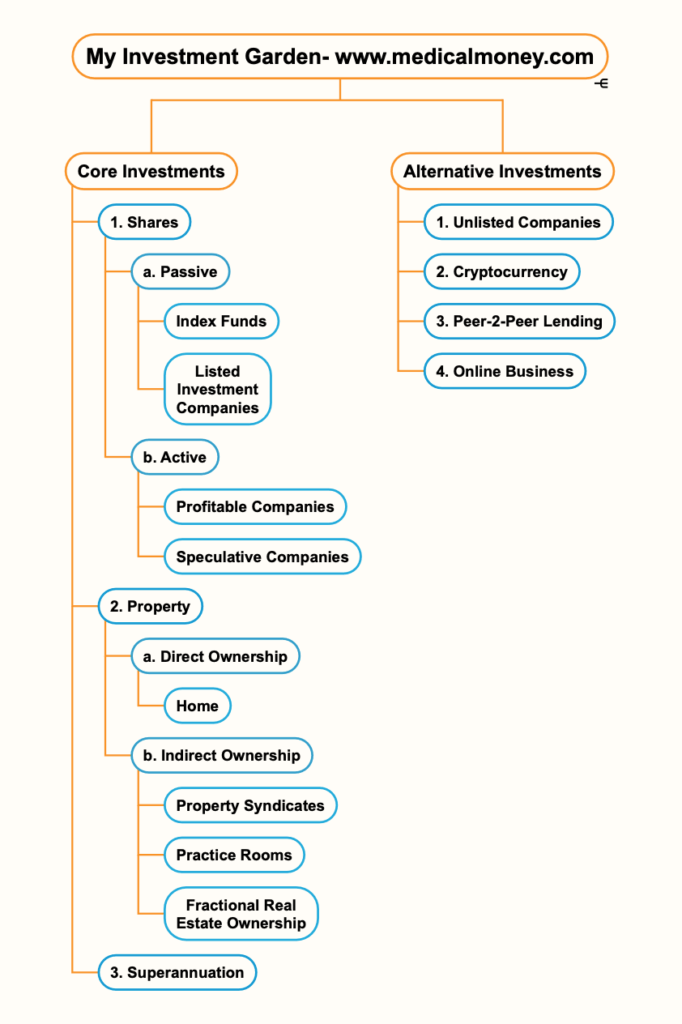

Let me share with you my Investment Garden in a mind map. I like to think of investment portfolios as a garden because we can be selective about what investments we plant and grow. Just like a real garden, it’s time and patience that does most of the work.

The large majority of my portfolio is in Core Investments but I also get to play around a little bit to keep learning about what alternatives are out there.

Core Investments

Shares

I like shares for 2 reasons- the potential is uncapped and the risk is limited to the amount you put in.

Passive- I invest in Index Funds as you can see from my Passive Portfolio where I put in $2,000 into VAS and IVV. I also have some other broad-based ETFs and LICs. They are like buying a pre-established apple tree. Its roots are deep and it produces fruit year after year without you having to worry about it..

Active- I separate this into companies that are already profitable and speculative ones that are still losing money. The profitable companies are still growing and they often shell-off dividends while they continue to grow. They are like buying a plant that’s already started growing but it still needs some TLC and you need to watch out for caterpillars. The speculative companies are a bet on a future story that the broader world hasn’t seen yet. They are small and still capital intense. Like a recently planted seed, the smallest changes in weather can signal their end. I invest in “speccies” because they make me see a better future where I get to board the rocket before it takes off.

Real Estate

Direct- we had residential investment properties but simplified our life and shrank our mortgage when we bought our family home. I like not having to deal with tenants.

Indirect- I hold units in unlisted property syndicates which have non-recourse loans and are looked after by a management company. My share in my group practice entitles me to portion of our rooms and I have a tiny amount in BrickX. BrickX is a nifty innovation that invests in residential property across Australia. It fractional real estate ownership where each property is divided into 10,000 bricks. You can invest in just a single “brick” which works like a share in a company- you get your share of rental income and can sell it for a profit. My readers can get a $40 bonus for your first bricks by clicking this link but read the PDS and DYOR.

Superannuation

I’m just with an industry super fund and make my $25k concessional contribution each year. I just opt for the high growth option because I still have a long time before I can access it.

Alternative Investments

Unlisted Companies- I have shares in a Fintech company called Apxium and Smileyscope. Bi has done a great job bringing us early-stage medical companies through his group Australian Medical Angels.

Cryptocurrency- similar to speculative companies, Bitcoin is a bet on a different future. What that future is, I have know idea, but I’m happy to hold some tickets. The halving rate is occurring in May so we are now seeing a nice price rally.

Peer-2-Peer Lending- there are a number of players in the market. I have a small amount with RateSetter which lets you invest with just $10. As an investor, my money gets lent out to a borrower who pays me interest. RateSetter matches my money with borrowers and takes a commission on the interest payment. Some of my funds are currently lent out at 7%. You can get a $50 bonus using this link but again, read the PDS and DYOR!

Online Business- this website makes me some beer money when readers use my affiliate links. I also have a couple of other sites that give me Google Adsense revenue. It helps me to cover the cost of hosting this site and producing the podcast. On a dollar per hour basis I am way behind and would make more money working in a sweat shop given the hundreds of hours I put into writing these posts and producing my podcast episodes. FYI a podcast episode takes me at least 5 hours to research, record, edit and load. It’s really a passion project where the positive feedback I get fuels me to keep producing quality content.

So there you have it- My Investment Garden.

What does your Investment Garden look like?

Share it in the comments below or send me an email andrew@medicalmoney.com