Disclaimer: This post/ podcast is not financial advice and all opinions expressed by podcast participants are solely their own. Please seek professional advice before making any financial or investment decision. The page may contain affiliate links. See the disclaimer for more info.

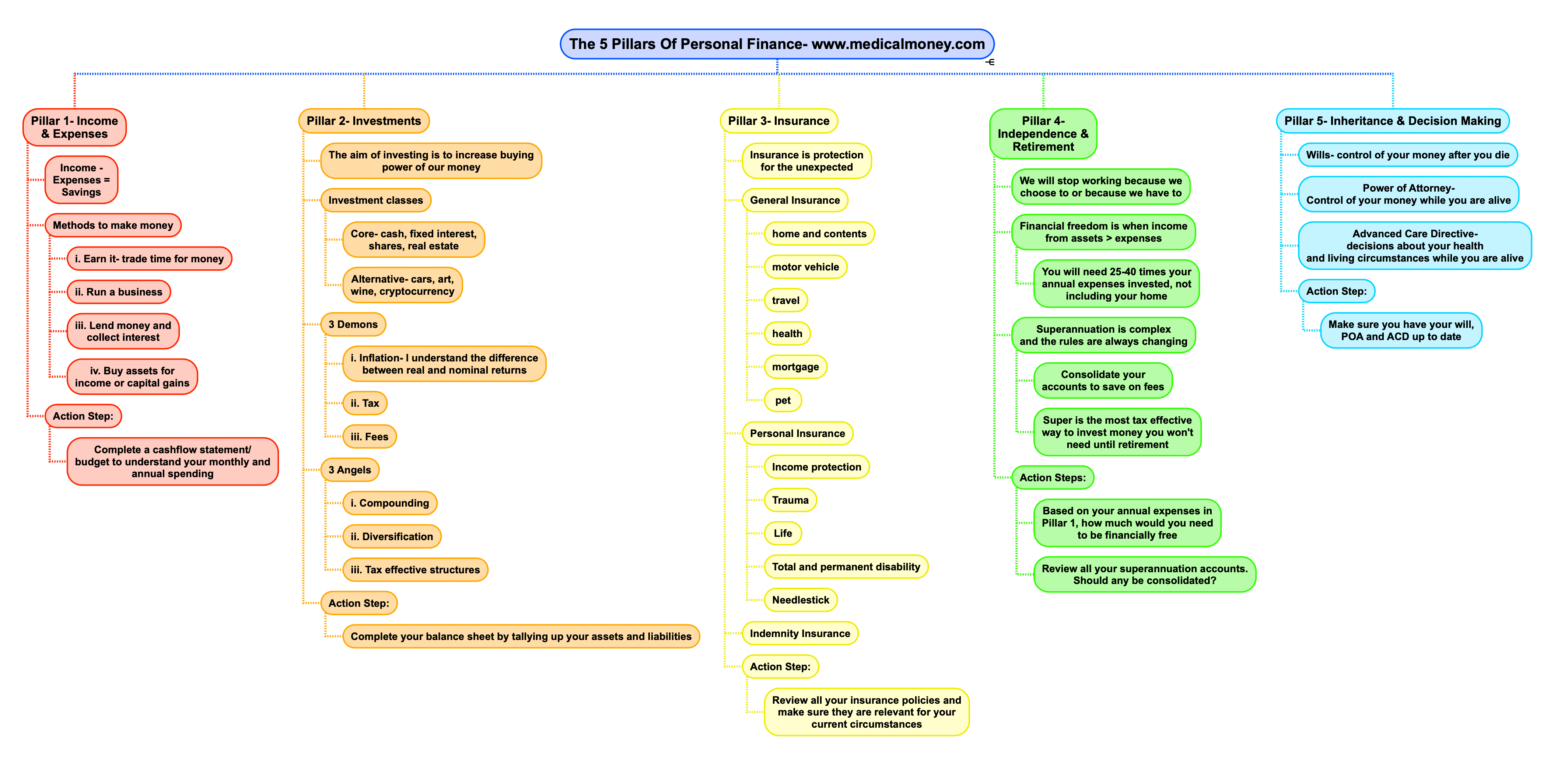

These are my 5 pillars of personal finance- it’s my framework for thinking about my money and a lot of my podcast content is anchored to these pillars. Using this structure will enable you to have a meaningful conversation with a financial planner about your current situation.

Click here to enlarge the mind map.

Transcript:

Today I’m going to share with you my 5 pillars of personal finance- it’s my framework for thinking about my money a lot of my podcast content is anchored to these pillars.

I used to be obsessively focused on chasing the next big thing and wasted a lot of money and time – just ask my wife.

But perspectives change as you get older, the amounts get bigger and you have mouths to feed.

Completing my diploma in financial planning last year helped me a more global and holistic approach to my finances. It also pointed out major blind spots in my thinking.

Like the old saying goes- you don’t know what you don’t know.

There are a lot of concepts in this episode so I have created a flow chart to make it easier for you to follow. Get the chart at medicalmoney.com/pillars

This is another MMI episode where Its just me and the voices in my head so please share your perspectives with me by sending me an email at andrew@medicalmoney.com

As med students we were taught a 5 pillar approach to clinical medicine.

Essentially we all use the same 5 elements

- History

- Exam

- Investigations

- Diagnosis

- Treatment

To monitor progress we do a periodic review.

Whether you’re a GP, surgeon or anaesthetist like me, we are always using this framework in our professional lives.

Let me introduce you to a 5 pillar framework you can use in your personal financial life.

Conveniently I’ve made them all begin the letter I. The letter I also looks like a greek pillar.

I want you to visualise these 5 Is as the pillars holding up your financial parthenon.

The pillars are:

- Income

- Investments

- Insurance

- Independence

- Inheritance

Now let me elaborate on each of these and some of the key elements you might want to consider. For every pillar I’ll also include an action step for you to complete.

The action steps are important because while knowledge is power, only action gets results.

Pillar 1- Income & Expenses

This is about understanding how cash flows in our lives.

The aim here is to have more income than expenses where income minus expenses equals savings.

If you don’t have savings, you have a real problem and should get it checkout out by a trained professional.

So how can we increase our income?

Well there are 4 main ways to make income let me explain

- earn it by trading time and expertise for money- most us do this in our clinical practice

- run a business which leverages other peoples time and money. many doctors do this by owning their own clinic and having contractors

- lend money out and receive interest- this includes savings accounts, fixed deposits and bonds are

- buy assets that give an income stream or can be sold for a capital gain.

What about expenses?

The key here to separate needs from wants. Necessities from nice-ities

As doctors we get paid more than enough to cover our needs, its our wants that cause us problems.

I believe we can have anything we want, we just can’t have everything we want.

There is no problem with buying a Porsche, Rolex or Birkin. We all need dreams to inspire and motivate us.

I once heard someone say the key to happiness is to have what you want, but also want what you have.

I’m also a believer that looking for ways to increase income is more progressive than going full out frugal. It’s like a game of football or any ball sport for that matter, defence is important but you actually need to kick some goals to win the game.

Income action step:

Complete a cashflow statement by listing your income and expenses for a typical month and year.

I’ve created one for you at medicalmoney.com/cashflow

Pillar 2- Investments

The reason we invest is to increase the buying power of our money in the future.

The reason we need to invest is because we can’t work forever and neither can we trust that the government will look after us. Just Look at the huge amount of debt they are in right now.

There are so many different types of investments we can’t mention them all here.

I categorise investments into 2 main groups- core and alternatives

Core investments which is made up of fixed interest, cash, shares and real estate. Core investments tend to have good government supervised regulation and they are more likely to have liquidity if you need to sell.

Alternative investments include cars, art, wine, cryptocurrency. These tend to have less liquidity and may be largely unregulated putting your assets at risk.

Now I want to share with you the 3 demons and 3 angels of investing. I was raised catholic so forgive me for the analogy.

There are 3 money demons we face every day of our lives. Like the devil they are there burning our money.

- demon 1 – inflation where the cost living goes up over time. Its important to understand the concepts of nominal and real returns where real returns factors in the effect of inflation.

- demon 2- tax. the public coffers will always want a share of our good ideas and hard work

- demon 3 fees- this is the sandpaper that wears away our money. it comes in the form of brokerage, stamp duty and management fees.

So what are the 3 angels of investing?

They are the principles that will guide us towards financial heaven

- Angel 2 Compounding- in episode 8 i explained how the aim of investing is to make our money have money babies and for those money babies to hav more money babies. The earlier we start making money babies the more our money can grow. But there is another element to compounding and that the compounding of our knowledge and confidence over time.

- Angel 2- Diversification- spreading our money into different asset classes helps insulate us from a cataclysmic disaster. We talked about core and alternative investments a moment ago. For me, I really like shares because you can only lose what you put in and i can get exposure to in different industries and different geographical locations. Others love property and that’s great. My advice is pick a couple of asset classed that interest you and spend some time learning about them.

- Angel 3- Tax effectiveness structures. This is hugely important given that most full time doctors are on the highest marginal tax rate. Make sure you have a good accountant to advise you here. Using the correct holding structure will save you tax and offer you an element of protection should someone decide to sue you personally. Some assets are also more tax effective, an example is investing in companies that have ESIC status which makes them capital gains tax exempt if you sell within 10 years.

Investment Action step

Complete a balance sheet by tallying up all your assets and liabilities.I’ve made one for you at medicalmoney.com/networth

Are your assets diversified? Are your structures tax effective?

Pillar 3 – Insurance

Th purpose of insurance is to provide financial protection from the unexpected.

Unfortunately nothing has been able to protect us from COVID 19.

Insurance can be divided up into 3 categories.

First category is general insurance. General insurance policies allow you to insure your

-home and contents

—motor vehicle

-health

-travel

-mortgage and

-pet

The second category is personal insurance where there are 5 main policies.

- income protection- pays you if you can’t work due to illness or injury. as doctors we want to make sure we are covered for own occupation not any occupation. Since 2014 income protection within super is only able to cover any occupation so technically you won’t get paid out if you can still flip burgers at Maccas. Income protection payouts are paid monthly and are taxable but premiums are tax deductible.

the next 4 personal insurances have lump sum payouts.

- life insurance: this pays upon death or end stage terminal illness where you have only months to live

- trauma insurance: this covers cancer, heart attack, stroke and a number of other traumatic events. You get paid even if you make a full recovery. The money is to alleviate financial stress while you seek treatment and convalescence.

- total and permanent disability insurance or TPD: gives a payout when you can no longer do your job due to an ailment that meets your policy criteria. Common conditions include neurological disease like MS. Interestingly, a significant number of payouts are for mental health.

- needle stick: this pays if you get contract a blood borne disease that precludes you from work. For example if you stuck yourself as a surgeon and contracted HIV, you would no longer be able to continue your normal practice.

The third category of insurance is professional indemnity.

This insurance protects you from malpractice, clinical errors and other complaints.

I believe Its worth taking out an indemnity policy even if you are a medical student or full time hospital employed.

If you own a practice then there are policies associated with running a business but they are beyond the scope of personal finance.

Insurance Action step:

Take a look at your general, personal and indemnity insurance policies.

Ask yourself- Are they still relevant for your current circumstances?

Are you appropriately covered?

If not then now’s the time to get them sorted.

Pillar 4- Independence and Retirement

At some point we will stop working as doctors either because we want to or because we have to.

Ther key points to discuss here are financial freedom, retirement and superannuation.

Financial freedom

We can choose to stop work when we have reached a point of financial freedom. This is the point where our income from investments is greater than our expenses.

So how much do you need to be financially free?

Everyone is different but roughly, you will need an investment portfolio that is 25-40 times your annual expenses.

This number os bigger than most people realise but it means you won’t have to touch your principal when you stop work. Effectively this will fund you until death leaving your assets to be passed on.

If you plan to draw down on your principal then obviously you might not need qan investment portfolio that big.

Just remember your house is not included as an investment as it not income generating nd you can’t eat your house when you run out of money

Retirement and Superannuation

The government has the superannuation scheme to help us save for our retirement.

Superannuation is a very complex topic and legislation is always changing.

At its core, the government wants us to provide for ourselves during retirement. But on the other hand, they don’t want us to get too many tax benefits from ploughing all our money into super.

Super is very advantageous from a tax perspective compared to investments outside of super. The downside is we have to wait until we retire or hit our preservation age to get our hands on our cash.

While we work our super is in accumulation phase. Upon retirement we can commute up to $1.6 million dollars into a pension phase account. Pension phase accounts are tax free.

Super is very complex and we all need paid finical advice to plan for retirement.

If you don’t understand the difference between concessional and non concessional contributions then it’s time to speak to someone who does.

Independence action step:

Calculate how much you need to have in investments to become financially free. To do this take your annual expenses from the action step in Pillar 1 and multiply it by 30.

Then go and get an update on all of your superannuation statements so that you know how much and where your super is being held. You may need to consider consolidating some accounts to save on wasted fees.

Pillar 5- Inheritance and Decision Making

The questions you need to have answers to are what do you want to happen when you die or become incapacitated?

There are 3 legal documents you need to have prepared- they are a will, power of attorney and advanced care directive

- Will- this decides how your assets will be distributed and who will look after your dependants. The notion of a testamentary trust that holds your assets needs to be explored and you can’t do this on a $10 will kit from your newsagent. Pay to get a lawyer.

- Power of attorney- this expresses who you want to make financial decisions on your behalf when you ae unable to make them yourself

- Advanced care directive- this expresses your wishes, preferences and instructions for health care, end of life and personal matters. You can appoint one or more substitute decision makers to act on your behalf.

In an upcoming episode my lawyer Tim will explain each of these in more detail and give examples of how things can go wrong.

Inheritance Action Step

Review your will, power of attorney and advanced care directive. Are they relevant to your current circumstances or do they need to be updated?

If you don’t have all 3, then its time to get them created.

So there you have it. My 5 pillars of personal finance.

- Income

- Investments

- Insurance

- Independence

- Inheritance

I urge you to assess each one individually and take action if necessary.

Its easy for us to say we will leave it until tomorrow but the problem is that tomorrow never comes.

I hope my framework gives you a structure upon which you can grow your knowledge base. If anything it will enable you to have a meaningful conversation with a financial planner about your current situation.

Thanks for listening today, please send me an email, I love getting your feedback and always try to respond as quickly as I can.