Do you know your investment risk profile?

Are you someone who can’t sleep if your investment lost a dollar? Or are you happy throw money at 10 different startups with the expectation that one will get you a 100x return while 9 others will die a cruel death?

In this post you’ll identify your Investment Risk Profile in just 5 minutes

The way we approach financial risk is often a function of the lessons our parents taught us and our experiences with money- both good and bad.

When we understand how we accept and respond to investment risks, we are empowered to make better financial decisions and sharpen the focus on our goals.

Your Investment Risk Profile assessment takes into account a number of factors including:

- your investment experience

- the duration you need your investments to last

- how you deal with small fluctuations and large crashes in your portfolio value

This means that your risk profile evolves and should be reassessed every 2-5 years.

What’s The Purpose of Understanding Risk?

Recognising your risk profile is central to creating a financial plan that will work for you. It enables you to:

- decide how to allocate your capital

- calculate your expected returns over time

- identify if your desired goals are reasonably going to be achieved

- plan how your portfolio will evolve over time as your life, experience and needs change

“He who is not courageous enough to take risks will accomplish nothing in life.”

Muhammad Ali

Getting Started- Take the Quiz

Read and answer the 10 questions below.

Give yourself a score for each answer that most closely represents you- the actual you and not the “imaginary super you” (the one that wants to be brave when others are scared and that expects every stock pick to hit it out the park).

Add up your score to find out whether you are a Conservative, Moderately Conservative, Balanced, Assertive or Aggressive in your risk profile.

There are 3 additional questions that identify your experience with leveraging (borrowing) other people’s money.

1. Which of the following best describes your current stage of life?

a. Single without many financial burdens. Ready to accumulate wealth for future. (5 points)

b. A couple with no children. Getting ready for the future by establishing a home. Expecting to have or already have a high purchase rate of household and consumer items. (4 points)

c. Young family with a home. You have a mortgage and childcare costs and maintain only small cash balances. (3 points)

d. Mature family. You are in your peak earning years and your mortgage is under control. You both work and you may or may not have children that are growing up or have left home. Ready to start thinking about your retirement years. (5 points)

e. Preparing for retirement. You own your home and have few financial burdens; you want to ensure you can afford a comfortable retirement. (2 points)

f. Retired. You rely on existing funds and investments to maintain your lifestyle in retirement. You may already be receiving a Government pension and/or Superannuation pension. (1 points)

| 2. How familiar are you with investment matters? |

| a. Not familiar at all with investments. The complex nature of financial makes you feel uncomfortable. (0 points) |

| b. Not very familiar when it comes to investments. (1 point) |

| c. Somewhat familiar. Don’t fully understand investments, including the share market. (2 points) |

| d. Fairly familiar. You understand the various factors which influence investment performance. (3 points) |

| e. Very familiar. You use research and other investment information to make investment decisions. You understand the various factors which influence investment performance. (7 points) |

| 3. How long have you been investing, not counting your own home or bank type deposits? |

| a. 3 years or more. (5 points) |

| b. Up to 3 years. (3 points) |

| c. This is your first investment. (1 point) |

| 4. How long would you invest the majority of your money before you think you would need access to it? (Assuming you already have plans in place to meet short term cash flow and/or emergencies). |

| a. In 2 years or less. (1 point) |

| b. Within 3 – 5 years. (3 points) |

| c. Within 6 –10 years. (7 points) |

| d. Not for 10+ years. (10 points) |

| 5. Once you start using your invested money how long would you need it to last? |

| a. Over a period of 2 years or less. (0 points) |

| b. Over a period of 3 – 5 years. (1 point) |

| c. Over a period of 6 – 10 years. (3 points) |

| d. More than 10 years. (5 points) |

| 6. In October 1987, the share market fell more than 40% during the month. If the share component of your portfolio fell by 40% over a short period, such as a month, would you: |

| a. Sell all of the investments. You do not intend to take risks. (1 point) |

| b. Sell a portion of your portfolio to cut your losses and reinvest into more secure investment sectors. (3 points) |

| c. Hold the investment and sell nothing, expecting performance to improve. (5 points) |

| d. Invest more funds to lower your average investment price. (7 points) |

| (If you have experienced a fall like this, choose the answer that corresponds to your actual behaviour.) |

| 7. If your investments fell by more than 6% over a short period, would you: |

| a. Sell all of the remaining investment. (1 point) |

| b. Sell a portion of the remaining investment. (3 points) |

| c. Hold your investments and sell nothing. (5 points) |

| d. Invest more funds. You can tolerate short term losses in expectation of future growth. (6 points) |

| (If your portfolio has experienced a drop like this, choose the answer that corresponds to your actual behaviour.) |

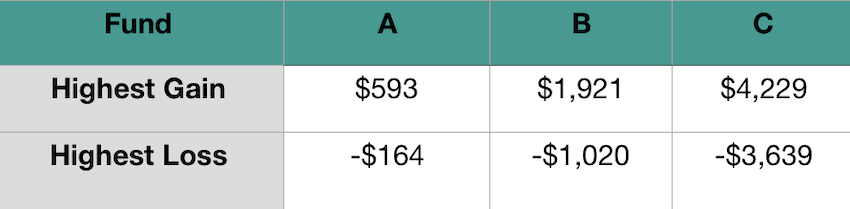

8. The table below shows the highest one-year gain and highest one-year loss on three different hypothetical investments of $10,000. Given the potential gain or loss in any one year, where would you invest your money?

a. Fund A. (1 point)

b. Fund B. (3 points)

c. Fund C. (5 points)

| 9. Which one of the following statements describes your feelings towards choosing an investment? |

| a. I would prefer investments with little or no fluctuation in value and have a low degree of risk associated with them. I am willing to accept the lower return associated with these investments. (1 point) |

| b. I prefer to diversify with a mix of investments that have an emphasis on low risk. I am happy to have a small proportion of the portfolio invested in assets that have a higher degree of risk in order to achieve a slightly higher return. I am prepared to accept a negative investment return of 1 in 10 years. (2 points) |

| c. I prefer to have a spread of investments in a balanced portfolio. I am happy to have a negative return of 1 in 7 years. (4 points) |

| d. I prefer to diversify my investments with an emphasis on more investments that have higher |

| e. I would only select investments that have a higher degree of investment price fluctuation so that I can earn higher long term returns. I am happy to accept a negative return of 1 in 3 years in order to achieve this goal. (12 points) |

| 10. How secure |

| a. Not secure. (2 points) |

| b. Somewhat secure. (3 points) |

| c. Fairly secure. (4 points) |

| d. Very secure. (5 points) |

11. Additional questions about leverage:

Apart from your home, have you ever borrowed money to make an investment?

Yes or No

Would you consider borrowing money to make an investment?

Yes or No

If Yes, what is the maximum level of borrowing (gearing) you are prepared to accept as a percentage of your net assets (your equity)?

___ percent

What’s Your Score?

Add up the points you scored for each answer. Based on the total points, you can compare your score with the range of Profiles described below.

Your Indicative Investor Risk Profile

0 – 18 points : Conservative

You are a conservative investor who does not wish to take any investment risk. Your priorities are the safeguarding of your investment capital. You are prepared to sacrifice higher returns for peace of mind.

19 – 25 points: Moderately Conservative

You are a moderately conservative investor who is prepared to accept a small amount of risk. Your priority remains the preservation of capital over the medium to long term. You may have some understanding of investment markets, however, you cannot afford to take any chances with your capital.

26 – 44 points: Balanced

You are a balanced investor with some understanding of investment market behaviour and can accept some short term risk to your capital. You do not wish to see all of your capital eroded by tax and inflation and are prepared to take a small short term risk in order to gain

45 – 55 points: Assertive

You are an assertive investor who understands the movement of investment markets. You are most interested in maximising long term capital growth, although you do not wish to make unbalanced investment decisions. You are happy to sacrifice short term safety in order to maximise long term capital growth.

56 + points: Aggressive

You are an aggressive investor. You are prepared to sacrifice your investment capital in pursuit of the highest long term capital growth investment. You are most interested in reducing your taxable income and have an understanding of the behaviour of investment markets.

How Should You Be Investing?

Do you invest for growth or income? Your risk profile will help you to decide.

If you’re aggressive you’ll have a greater percentage allocated to growth investments. Conversely, a conservative investor will allocate more to income generating assets.

This table gives you a rough guide to help you allocate your portfolio assets.

So What Did You Learn?

Now you have answered the questions above, what have you learnt about yourself?

What have you learnt about your portfolio needs?

What action do you need to take?

I love receiving your comments and feedback. Share them below or send me an email.